Engineering Industry Overview

The engineering industry is broad and plays a key role in many different industry sectors. It is very often stereo-typed with heavy industry and the hard hat job role. Given this perception, it can be challenging for those in engineering recruitment roles to overcome. However, engineering can range from innovations in new drug development through to developing advances in telecommunications.

The various sub-sectors of engineering include:

- Aerospace

- Automotive

- Building and property services

- Chemical

- Construction and infrastructure

- Electronics

- Environmental and geospatial

- Food Production

- Information Technology

- Life Sciences

- Manufacturing

- Medical

- Mining

- Ministry of Defence

- Oil and Gas

- Pharmaceuticals

- Power and energy

- Telecommunications

- Transportation

Firstly, it is estimated that 5.7 million employees work within the engineering industry in the UK. This accounts for approximately 19% of total UK employment.

Secondly, Engineering UK estimated that the engineering sector contributed 26% of the UK’s total GDPR in 2015. The contribution amounts to approximately £486 Billion and was a 2.3% growth from 2014.

Thirdly, the Engineering Salary Survey 2019 found that the average salary in the engineering industry is £51K per year (an increase of £48K from 2018).

Energy / renewables / nuclear claimed the highest average salary with £58K. Other sectors included in the survey ranked as follows:

- Oil and Gas = £57.1K

- Chemicals and Pharma / Medical = £56.2K

- Food & Drink / Consumer Goods = £52.8K

- Telecoms & Utilities / Electronics = £51.8K

- Aerospace = £50.2K

- Defence and Security / Marine = £50.2K

- Automotive = £49.7K

- Materials = £48.7K

- Rail / Civil and Structural = £46.3K

- Academia = £43.8K

Who Are the Major Employers in the UK?

The engineering industry and its various sub-sectors boast many large organisations operating in the UK.

Just by analysing the top 10 companies in the FTSE 100 index, you will see how many engineering firms are present:

- Royal Dutch Shell – Oil and Gas

- Unilever – FMCG and Manufacturing

- AstraZeneca – Pharmaceuticals and Life Science

- BP – Oil and Gas

- GlaxoSmithKline – Pharmaceuticals and Life Science

- BHP – Mining

- British American Tobacco – Manufacturing

- Diageo – Food and Beverage

- Rio Tinto – Mining.

As you can see, the only organisation in the top 10 that is not directly related to engineering is HSBC.

Whilst this hard hat perception has followed the industry there are companies in the sector that are regarded as desired to work for. Undoubtedly, this will serve to attract top graduates but this is one aspect the industry can try to improve on (as we will discuss later in the guide). Target Jobs surveyed the top engineering and manufacturing companies based on student and graduate’s opinion. The top 10 are:

- Rolls-Royce

- British Airways

- Jaguar Land Rover

- Airbus

- BAE Systems

- Boeing

- BMW Group

- Dyson

- Siemens

The full 300 list can be viewed here on Target Jobs

With so many top engineering companies scattered across the UK, we have listed examples of some of the top companies by major UK cities surrounding areas:

Birmingham:

- Mondelez International

- Jaguar Land Rover

- National Grid

- Cromwell Tools

- Volvo Group

- Siemens

- GE

- Eaton

- Cummins

Bristol:

- Airbus

- Rolls Royce

- GKN Aerospace

- Babcock

- Hewlett Packard

- Danone

- Renishaw

- Imperial Brands

- Hillarys Blinds

- Stryker

- Dyson

- Infineon Technologies

Cardiff:

- GE Aircraft

- Dow Silicones

- CELSA STEEL / Holdings

- Wales and West Utilities

- Calon Energy

- Finsbury Food Group

- PHS Group

- Ipsen Biopharm

- Panasonic Manufacturing

- Tata Steel

- Mitel Networks

London:

- Royal Dutch Shell

- BP

- GlaxoSmithKline

- Unilever

- Vodafone Group

- AstraZeneca

- Rio Tinto

- BT

- British American Tobacco

- Virgin Atlantic Airways

- BA

- BHP

- Balfour Beatty

Manchester:

- AstraZeneca

- Arup

- Unilever

- Kellogg’s Company

- Siemens

- Sky UK

- BBC

- Umbro

- Warburtons

- PZ Cussons

- The Peel Group

- McVitie’s

- ITV Studios

- Gazprom

Engineering Job Market

To meet the industry employment demands forecasted to 2024, it is believed that engineering companies will need to recruit 265,00 skilled workers annually. That amounts to quite a significant talent pipeline required by engineering recruitment to deliver.

However, the demand for people with engineering skills is not being met through the education system. This means that there will be a shortfall between 37,000 and 59,000 engineering graduates each year to fill key engineering roles as forecasted by Engineering UK.

The below table is sourced from the Office for National Statistics (ONS) and highlights the total number of employment by Industry SIC in 2019.

| Count | Employment | Turnover (£’000s) | |

| Mining and Quarrying | 1,240 | 53,138 | 33,404,062 |

| Manufacturing | 136,930 | 2,449,922 | 589,252,623 |

| Electricity | 4,620 | 115,494 | 106,612,432 |

| Water | 5,035 | 111,399 | 28,919,142 |

| Construction | 205,395 | 1,080,925 | 219,361,093 |

| Repair Vehicles and Transport | 46,055 | 235,106 | 28,486,972 |

| Information and Communication | 184,215 | 978,716 | 194,904,341 |

| Professional | 114,260 | 635,500 | 94,894,365 |

| Administrative and Public | 2,520 | 61,142 | 2,996,645 |

| Other Services | 6,935 | 35,366 | 5,653,722 |

| Engineering Footprint | 707,205 | 5,756,708 | 1,304,485,397 |

| Whole economy | 2,718,435 | 31,167,073 | 5,822,865,832 |

Key Employment Trends

Trends by Sector

- There are some engineering sectors witnessing growth while others are in decline. The growth sectors are those within information and communications based sectors. Comparatively, those that are within the manufacturing sectors are experiencing a decline.

- 4% of employees working in the engineering industry are working for companies that employ between 50 and 499 employees. 34.2% of employees worked for companies under 25 employees whilst, 18.4% worked for companies larger than 500 employees (ONS Labour Force Survey, 2016)

- Distribution and transport had the highest proportion of engineering employees in businesses with fewer than 25 employees (69.7%). This was followed by construction (46.1%), repair of machinery (40.0%), wood and paper manufacturing (39.0%), metal manufacturing (38.1%), textiles and clothing (35.3%) and professional services (35.1%). At the other end of the scale, vehicle manufacturing had the highest proportion of employees in large businesses with 500 or more employees (48.8%), followed by defence and other sectors (46.1%), food, drink and tobacco (26.9%), and energy and water supply (26.5%).

- Sectors that accounted for most of the companies with less than 25 employees were distribution and transport (69.7%), construction (46.1%), repair of machinery (40.0%), wood and paper manufacturing (39.0%), metal manufacturing (38.1%), textiles and clothing (35.3%) and professional services (35.1%).

- Sectors that accounted for most of the companies with 500 or more employees were vehicle manufacturing (48.8%), defence and other sectors (46.1%), food, drink and tobacco (26.9%), and energy and water supply (26.5%).

Trends by Location

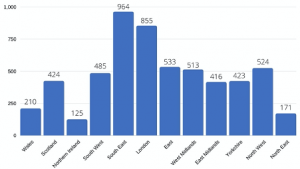

- There are trends in the number of engineering employees based on location with London and South East providing the two largest regions by the workforce. See graph below for a breakdown by region (ONS Labour Force Survey, 2016)

Trends by Occupation

- The sectors with the largest representation of managerial, professional and technical employees were Communication and computing (85.4%), Professional Services (78.9%) and Mining (63.8%). Sectors with the lowest were distribution and transport (16.2%), wood and paper (26.6%) and food, drink and tobacco (27.7%).

- A skilled craft workforce was required in distribution and transport (54.8%), construction (43.7%) and machinery repair (40.3%) sectors.

- The sectors that had the highest amount of semi or unskilled works were food, drink and tobacco (53.3%), textiles and clothing (31.8%) and machinery (28%).

(Source: Engineering UK 2018: The State of Engineering)

Key Skills and Qualifications

To cater for an industry with a diverse range of sectors, the skills and qualifications required are equally diverse.

For professional and skilled jobs, degree-level qualifications are often required. The degree subjects are often related to STEM (Science, Technology, Engineering and Manufacturing) and catered for by many of the leading UK universities. Popular STEM course for the engineering industry are:

- Architecture, building and planning

- Biological Sciences

- Computer Sciences

- Civil Engineering

- Mechanical Engineering

- Aerospace Engineering

- Electrical Engineering

- Chemical Engineering

- Maritime and Geo Sciences

- Mathematical Sciences

- Physical Sciences

- Medical Sciences

Recruiting Graduates

One of the key challenges for the UK Engineering industry is the fast-changing landscape of job skills required and the skills that new graduates to the industry provide.

Engineering has faced its problem in attracting students on to graduate courses and also into Modern Apprenticeship Schemes. Reasons can be attributed to:

- a failure to attract enough of the right quality of young people to study engineering, partly due to a poor image

- declining interest in taking maths and physics at ‘A’ level

- continuing low take-up by women on engineering courses

- attractions of alternative options (especially studying IT)

- more encouragement is given to young people to stay on at school than to follow vocational routes which involve workplace training

The Future Landscape

Leading up to 2024 it is forecasted that there will 2.5 million job openings across the engineering sector.

Comprising of 2.5 million jobs will be 1,170,000 graduate and technician engineering jobs. The following sectors are predicted to make up the majority of these graduate and technician vacancies:

- Construction – 29.8%

- Manufacturing – 24.7%

- Information and communication – 18.9%

- Professional, scientific and technical activities – 15.8%

- Other sectors – 10.8%

How HR Managers Can Recruit Top Engineering Talent

According to PWC’s 17th Annual Global CEO Survey – Key Findings in the Industrial Manufacturing Industry, only 32% of companies implement strategies to attract or retain talent.

As the employer and employee relationship landscape changes, companies that implement a talent management strategy will inevitably benefit.

Below, we have outlined some key considerations when developing a talent management strategy.

1. Develop a strong brand message for new recruits

It is no longer sufficient to provide the basic requirement in terms of pay, benefits, job security, and advancement opportunities.

As the millennial generation enters the workforce, they are increasingly engaged by a company’s brand values, working culture, training and development opportunities. Company’s need to develop a compelling message to ensure they are attracting top talent.

This will benefit the industry as a whole to create an attractive image to entice students and graduates to choose a career in the engineering industry. So with STEM skills being transferrable to other industries such as software and finance they are prising top engineering talent away.

2. Expand your talent network

In today’s competitive environment, the companies who wait to battle it out for students once they have left college may find that:

- Students have chosen alternative careers, or

- Top talent has already been identified by proactive recruiters.

Outreach to schools and colleges to engage students to your brand and the various opportunities will reap rewards. Some companies are offering scholarships for engineering students who demonstrate high academic potential.

Using your company’s online presence and social media outreach can be a great way of promoting your brand to future top talents.

With the vast amount of information available to millennials online, they no longer just choose careers and industries. They choose a brand that aligns with their values and ambitions.

3. Accessible training and development

Top talent will expect companies to have a central role to play in improving their skills and personal development. As different technologies and innovations enter the engineering workplace the need for new skill adoption will be required at a rapid pace.

Top talent will want to be able to keep their CV ahead of their competition but also ensure they have the tools and knowledge to progress in their career.

As online training and eLearning becomes widely accessible, companies should have training resources and programme readily available for employees.

Companies should also implement an onboarding process for new recruits. The on-boarding process is vital to ensure new recruits are engaged with the brand, company culture and clear direction on how to perform in their role.

4. Create an expert HR team

PWC’s 17th Annual Global CEO Survey found that most manufacturing CEO’s do not have confidence in the HR departments to find the right talent.

As highlighted in this guide, the need for talent in the industry is critical to its success.

Very often HR professionals are generalists or have been up-skilled from administrative roles. They often lack the specialist skills or knowledge to attract and retain top talent.

For example, HR teams might be strong in managing employee relations but may not have the appropriate skills to recruit top talent. So, if you do not have the appropriate skills in house or have a small HR team then consider outsourcing specific roles to specialist engineering recruitment agency.

How Sigma Recruitment Works with the Engineering Sector

Sigma Recruitment is a specialist Engineering Recruitment Agency. We take a consultative approach to finding our clients the best candidates.

As specialist recruiters, we have an extensive understanding of what both candidates and clients expect from each other when it comes to recruitment in the engineering industry.

We know what constitutes an ideal Biochemical Scientist candidate from meeting the expectations of a Civil Engineer.

Each of our clients has their own unique culture, brand and career development opportunities. As a result, we ensure our clients brand and expectations are conveyed to all of our candidates making sure there is a good fit for both client and candidate.

As a specialist in the Engineering Industry, we are able to attract an extensive database of candidates who are looking for their next career move. Once we have a clear understanding of our clients scope and brief we get to work on our 5 step process. We build a bespoke candidate search plan which incorporates a mix of our in-house database and candidate advertising expertise to find quality candidates for the role.

Click here for an in-depth explanation of our 5 step process. Below is the outline of the steps:

- Step 1 – Engineering vacancy qualification

- Step 2 – Engineering candidate and attraction

- Step 3 – Candidate screening, CV presentation, feedback and interviews

- Step 4 – Management of the job offer, start dates and aftercare

- Step 5 – Becoming an extension of your business to provide the best possible recruitment and HR service

Useful Links

Industry News:

Associations:

Institution of Engineering and Technology

Institute of Mechanical Engineers

Society of Operations Engineers

Institute of Marine Engineering, Science and Technology

Institute of Chemical Engineers

Chartered Institution of Civil Engineering Surveyors

Institute of the Motor Industry

Building Engineering Services Association